About Us

Founded in 2022, E N D Properties is a boutique real estate firm with a global outlook, offering bespoke services to an international clientele. Specialising in luxury home purchases, investment consulting, and crypto-integrated transactions, the firm blends tradition with innovation. Its pioneering division, Crypto Casas, leads the integration of digital currencies into real estate. A diverse, cross-cultural team delivers expert, seamless, and personalised guidance at every stage of the property journey.

At E N D, the focus is on service, vision, and exceeding client expectations—where your search ends and your journey begins.

LEARN MORE

Bespoke Services

Comprehensive, tailored solutions to support every stage of your property journey

— from crypto-enabled transactions to full-service property management.

From Our Blog

Stay updated with Dubai’s latest in real estate, lifestyle, investment trends, community developments, and more.

E N D Weekly Series

Stay connected with @endproperties. Use the shadowed arrows to browse our history.

Momentum Monday

Trend Tuesday

Walkthrough Wednesday

Team Thursday

Featured Friday

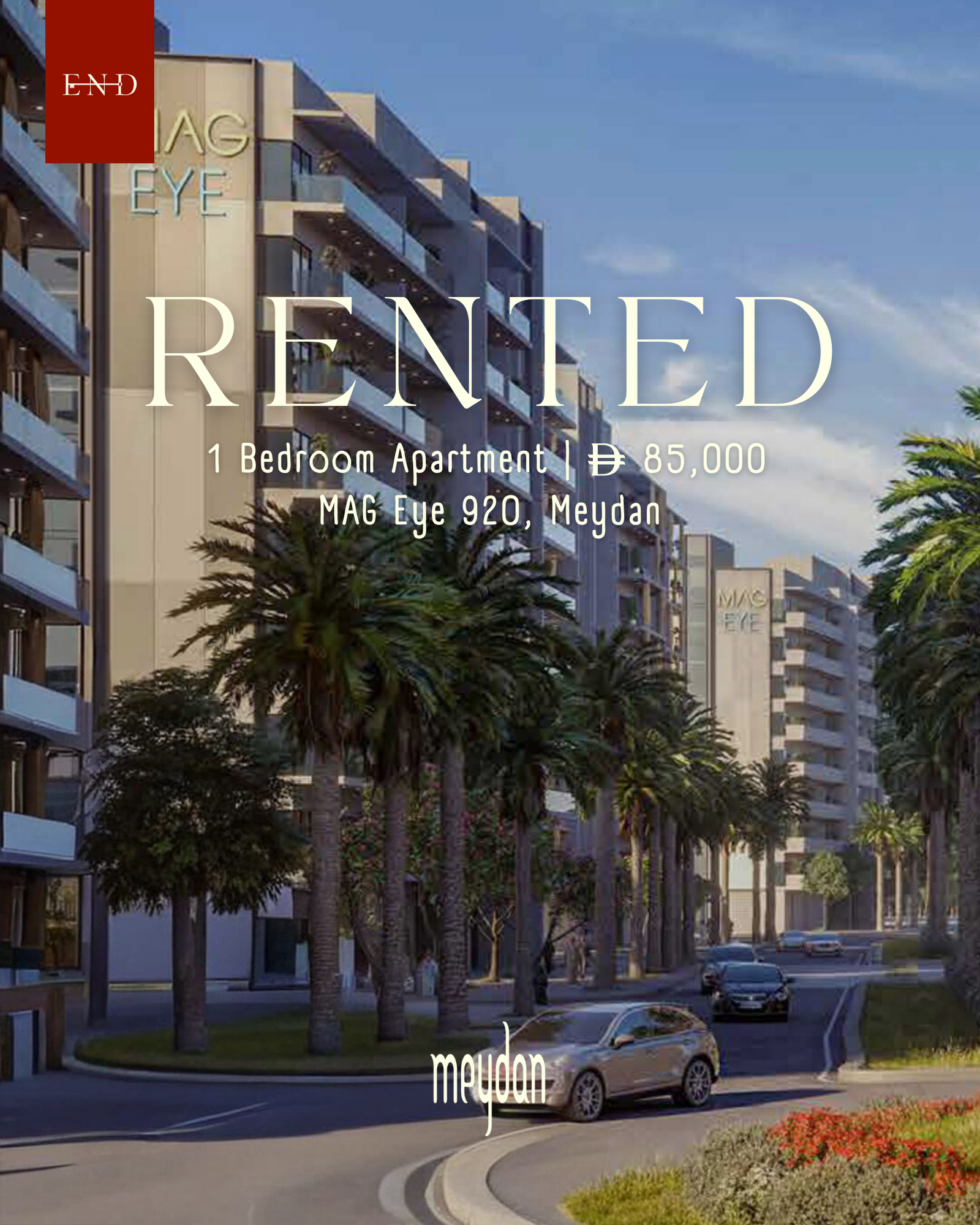

Success Saturday

Spotlight Sunday

What Our Clients Are Saying

Connect for a Consultation

Help us help you find your ideal real estate match!